Physician-Led Healthcare (PLH)

Empowering Physicians Through Ownership

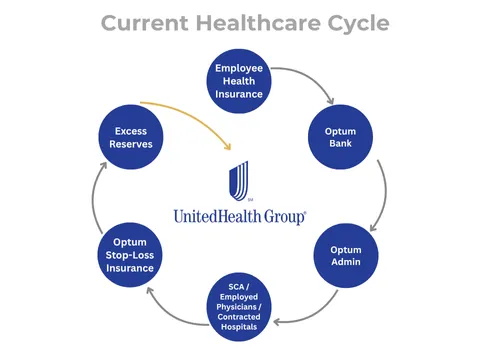

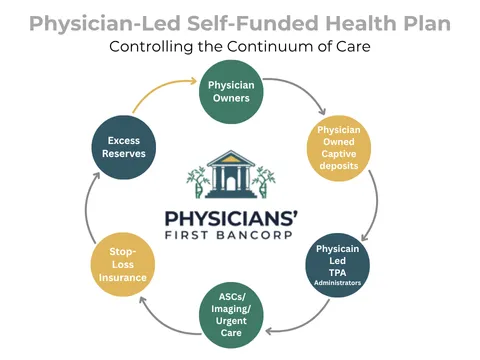

By dividing physicians, those who profit from care rather than provide it have built a system that views healthcare from the revenue down. Physicians First Bancorp is a financial holding company that unites physicians of all specialties and geographies in a single financial institution, allowing them to control the vast capital they generate. But more importantly, it allows you to control the continuum of care from the patient-physician relationship up.

Physician-Led Healthcare (PLH)

Empowering Physicians Through Ownership

Those who profit from healthcare rather than provide it have purposely divided physicians to maintain their unnatural control and power over healthcare delivery. Physicians First Bancorp (PFBI) is a financial holding company (FHC) that unites physicians across all specialties and geographies in an entity outside of Stark regulations, enabling physicians to monetize the vast capital they generate and take back control of healthcare.

BANK

Doctors are barred from owning hospitals, and some are prohibited from owning ancillaries, such as ASCs and imaging centers. Doctors can unite in the ownership of a financial institution (PFBI), taking them outside of Stark.

Physician-Led Health Insurance Plan (PLHIP)

Ownership in PFBI, a financial institution, allows for the creation of a Physician-Owned Self-Insurance Network, allowing doctors to own rather than rent the network.

CAPTIVE

All insurance requires a Captive (pool of risk money) to cover its patients' claims. PFBI allows physicians to own and manage this vast pool of capital. Enhancing the care of your patients and the payments to your practices.

WEALTH MANAGEMENT

IRAs and 401(k)s are a major part of a physician's retirement strategy. This is also a service you provide for your employees. Currently, some financial institutions hold and profit from these funds, often charging you to do so. PFBI allows you to own them.

Unlocking Revenue Potential by

Investing In Yourself

Almost every physician would invest in their own hospital if they could. Why? Because it would give you better control of the delivery of care to your patients while allowing you to generate revenue for simply doing something you do anyway.

We have applied the lessons learned along with the values ownership has brought to physicians in the ASC world to the potential ownership of a financial institute that is focused on you and your practices short and long term financial well being.

Traditional health insurance is the second-highest cost in your overhead. Worse, it has proven to be expensive with little value. Larger groups have shifted to self-insurance, offering savings on overhead while providing better quality insurance for their employees. PFBI takes this to the next level allowing all groups and all physicians to share in this benefit. Investing in PFBI completes the cycle, capturing and monetize the capital you are currently generating for others. PFBI creates Physician Led Health Insurance putting doctors in control of the continuum of care.

"It's your capital, own it!"

Physicians' First Bancorp

Bridging Healthcare Expertise

With Financial Growth

An exclusive investment opportunity designed to empower healthcare professionals, enable

professional growth & ensure sustainable post-retirement income.

Invest In the Persistent Challenges of

Financial Planning for Physicians

Are restrictive industry regulations such as Stark laws & CONs constraining your ability to integrate and grow your practice?

Have you experienced a lack of bespoke financial services designed to cater specifically for healthcare professionals?

Are you concerned about securing a financially stable future, particularly post-retirement income?

Is balancing complex financial planning alongside your demanding professional life becoming overwhelming?

Join others with the executive goal of helping physicians navigate their way to a secure future of financial success.

Addressing the Persistent Challenges of Financial Planning for Physicians

Are restrictive industry regulations such as Stark laws & CONs constraining your ability to integrate and grow your practice?

Have you experienced a lack of bespoke financial services designed to cater specifically for healthcare professionals?

Are you concerned about securing a financially stable future, particularly post-retirement income?

Is balancing complex financial planning alongside your demanding professional life becoming overwhelming?

We’re here to help you navigate your way to financial success.

Your 'Wealthcare' Starts Here

White Glove Services:

Ownership has its privileges. Owning and focusing a financial institution on you, your practice and your patients entitles you to concierge banking, insurance and wealth management services, but on your schedule not theirs.

Owning Your Capital:

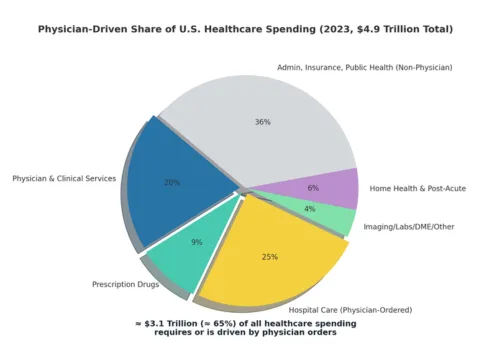

Physicians scripts drive 64% of the $4.6 trillion spent on healthcare annually. Owning the financial institution that manages this money allows you to monetize the vast amount of float you currently give away.

Enhancing, Rather Than Hindering Your Growth

Monitizing Your Capital

Theres a reason hospitals want to employe you and PE wants to own you. Its not just the money you generate from your hard work its the money you float. Currently you take on debt to grow your practices or just to survive, while others profit from this. It's time to own it.

Changing The Game:

Playing byTheir Rules

Spending large amounts of money and resources trying to change onerous regulations such as Stark, The Moratorium on Hospital Ownership and AKL has proven less than successful. PFBI allows you to play the game by their rules and still take back the continuum of care.

Invest in Physicians First Bancorp: Where Healthcare Meets 'Wealthcare'

Customized Financial Services:

Physicians First Bancorp provides personalized financial services tailored to cater to the specific financial needs of physicians.

Investment Opportunities:

We offer exclusive investment opportunities to physicians, allowing them to witness sustained financial growth and secure a steady income stream even beyond retirement.

Facilitates Professional Growth:

Through our services and opportunities, Physicians First Bancorp enables vertical integration within physicians' practices and bolsters their national presence in their field.

Regulatory Navigation:

We aid physicians in navigating restrictive regulations like Stark laws and CONs, breaking barriers to their financial and professional growth.

Join A New Financial Movement

Owned By Healthcare Professionals

Physicians First Bancorp is about more than just financial services — we're a revolution, reshaping the financial landscape for physicians like you. Here, you're not a mere number; you're the owner. You retain control, you enjoy the benefits — because the entity focuses on you.

So, be a part of the Physicians First Bancorp system. Together, let's redefine the dimensions of your financial growth. Your profession. Your future. Let's build it together.

Your Financial Success in Three Simple Steps

1) Enroll and Invest:

Begin by joining the Physicians First Bancorp family with an initial investment that falls between $15,000 to $150,000 range, based on what suits your financial status best.

2) Personalized Service:

Using our deep understanding of the medical field, we'll provide you with tailored financial solutions such as loans for practice expansion, ASC loans, patient loans, and more that align with your unique professional and financial needs.

3) Grow and Secure:

As your investment grows with us, you'll see it redefine your professional growth, enable vertical integration, and secure a steady passive income, even post-retirement. You remain in control, reaping continuous benefit from your investment.

Your Financial Success in

Three Simple Steps

Feel Free to Learn More

Take the first step towards financial autonomy and growth by scheduling a short call with us, one on one, where we can confidently share how we'll revolutionize the industry, together.

Review Documentation

Review Physicians' First Bancorp's business model to understand their operations, revenue streams, target market, and value proposition.

Strength in Independence

As independent physicians come together we can start to better control the care of our patients while protecting our financial interests and reimbursements, and create a pathway from earned income to passive.

Physicians Trust Us, Hear Why

“ Joining Physicians First Bancorp has been the most pivotal financial decision I've made in my career. Their understanding of my needs as a physician and the unique nature of my profession is unmatched.

The sense of control and certainty I have over my investments is refreshing. I couldn't recommend Physicians First Bancorp more.

Thomas J. Chambers, M.D.

“ Joining Physicians First Bancorp has been the most pivotal financial decision I've made in my career. Their understanding of my needs as a physician and the unique nature of my profession is unmatched.

The sense of control and certainty I have over my investments is refreshing. I couldn't recommend Physicians First Bancorp more.

Dr. Sophia Reid, Orthopedic Surgeon